The world of cryptocurrencies is always changing; analysts and investors monitor many factors to forecast future price swings of Bitcoin Price. The Market Value to Realized Value (MVRV) ratio is among the most perceptive measures applied to evaluate Bitcoin’s worth.

Recent declining to its long-term mean, this on-chain signal begs issues regarding the possible future direction of the price of Bitcoin. Especially, Bitcoin shot to an all-time high of $108,000 last time this happened. But is history about to repeat itself, and what does this decline to the long-term mean mean indicate for the price of Bitcoin?

MVRV Ratio and Bitcoin Valuation

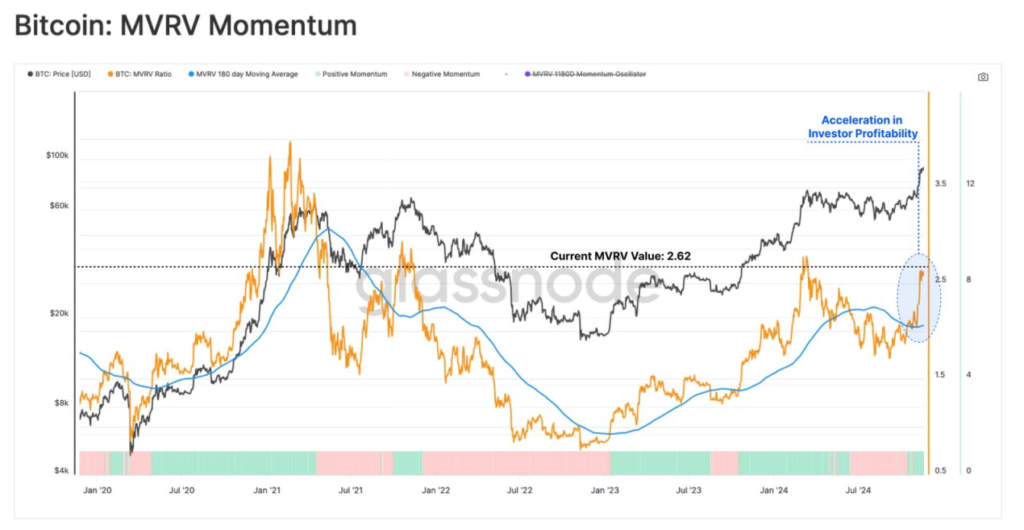

The MVRV ratio is a crucial metric that helps investors assess whether Bitcoin is under or overvalued. It is calculated by dividing Bitcoin’s market capitalization by its realized capitalization. The market capitalization is the total value of all Bitcoins in circulation at the current price, while the realized capitalization is the value of Bitcoin based on the price at which each Bitcoin was last moved.

When the MVRV ratio is high, it suggests that the market price is significantly above the realized price, indicating a potential overvaluation of Bitcoin. Historically, the MVRV ratio has been a useful tool for identifying market cycles and predicting potential price movements, offering a more nuanced perspective compared to other indicators like simple price charts.

MVRV Ratio Analysis

For the cycles in Bitcoin’s market, the MVRV ratio has been a key indication. The MVRV ratio often rises noticeably during times of market enthusiasm, indicating that Bitcoin might be overpriced and ready for a correction. Conversely, a declining ratio towards the long-term mean usually indicates an undervaluation, which can lead to a possible price surge.

Bitcoin had notable price increase in the past when the MVRV ratio was near to its long-term mean. For example, the MVRV ratio peaked in 2017 at 4.35, suggesting an overpriced market and before a price adjustment. Comparatively, the ratio peaked in 2021 at 3.7, signifying the height of the bull market prior to a dramatic downturn. Both times, once the MVRV ratio rose to high levels, the market had major price declines.

during around 2.64 right now, the MVRV ratio is far lower than the highs seen during past market tops. This implies that in terms of valuation, Bitcoin might be moving into a more balanced phase instead than being in an overbited state. For many, this offers Bitcoin a chance to gather momentum and maybe indicate the start of a fresh bull cycle.

Bitcoin’s 2024 Bull Run

Early 2024 saw the latest dip in Bitcoin’s MVRV ratio to its long-term mean. Bitcoin’s price at that point was hovering around $60,000, and the market was gingerly hopeful. Analyzers and investors began to conjecture that the market was setting itself for the next significant bull run. Combining the MVRV ratio with the long-term mean revealed that Bitcoin had found equilibrium between overvaluation and undervaluation.

After this alignment, Bitcoin’s price started to rise and later in the year it peaked at $108,000, all-time. Rising institutional acceptance, growing interest from regular investors, and more general macroeconomic conditions favoring assets like Bitcoin drove the previous climb to $108,000.

MVRV Ratio Analysis

Some analysts are comparing the situation before the previous surge to $108,000 as the MVRV ratio now once more approaches its long-term mean. Given past performance, this could be evidence that Bitcoin is getting ready for yet another notable price rise. The return of the MVRV ratio to the long-term mean points to a neutral state of the market rather than one that is either very bullish or very negative, as usually follows a significant price movement.

Past success, however, is not always a good indication of future outcomes. Although the MVRV ratio offers insightful analysis, it is not a certainty that Bitcoin will leap once more into the $100,000 region. Renowned for its volatility and impacted by several outside variables including macroeconomic trends, investor attitude, and legislative actions, Cryptocurrencies .

Many people, in spite of these unknowns, hope Bitcoin is about to enter another upward cycle. The present situation of the MVRV ratio indicates that there could be considerable possibility for gain if more institutional players enter the area and demand for Bitcoin keeps rising, particularly if more general market circumstances favor digital assets.

Final thoughts

One cannot overlook the current declining trend in the MVRV ratio of Bitcoin towards its long-term mean. Historically, this has been a hint of possible price swings; the last such event came before the record high of $108,000. Although this does not certain that Bitcoin will copy this performance, it does imply that the present state of the market might be preparing the ground for the next bull run.

To track if Bitcoin keeps showing indications of bullish behavior, investors should closely monitor the MVRV ratio as well as other on-chain statistics. As always, negotiating the erratic world of cryptocurrencies depends on carefulness and extensive study. Right now, the decline to the long-term mean could indicate that Bitcoin is ready for the next phase of its price trip—one that might send it even closer to fresh all-time highs.